Table of Contents

The Ultimate Guide To Buying A Business

Intro

Hey guys,

So the coronavirus has hit us hard in respect of business.

And there’s never been a more important time to consider diversifying your income streams.

Here’s the time right now – and like many of you if you’re watching – I’ve been rocked by an income hit from Covid-19.

We’ve lost 9-clients so far and as a consequence, I’ve decided to look at my income streams and dive deeper into alternative ways of generating an income.

_________

Defining Income

To clarify when I say income I mean ‘cash-flow’.

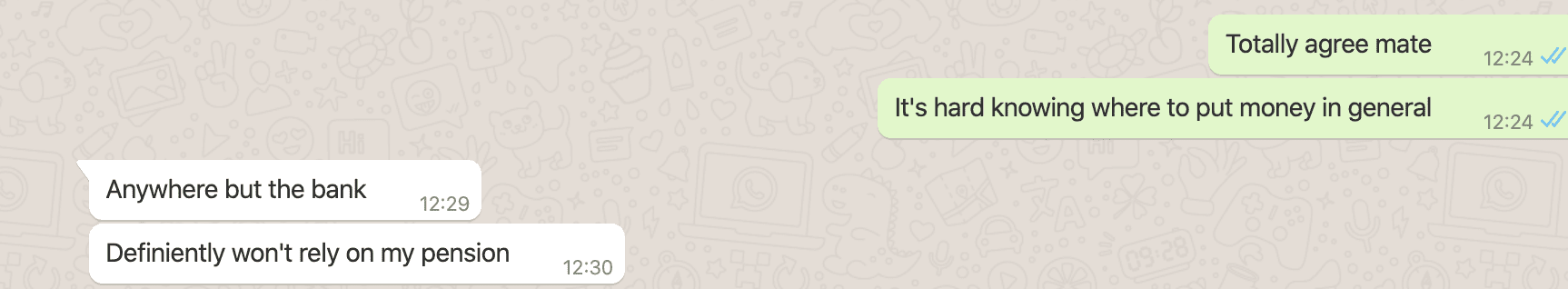

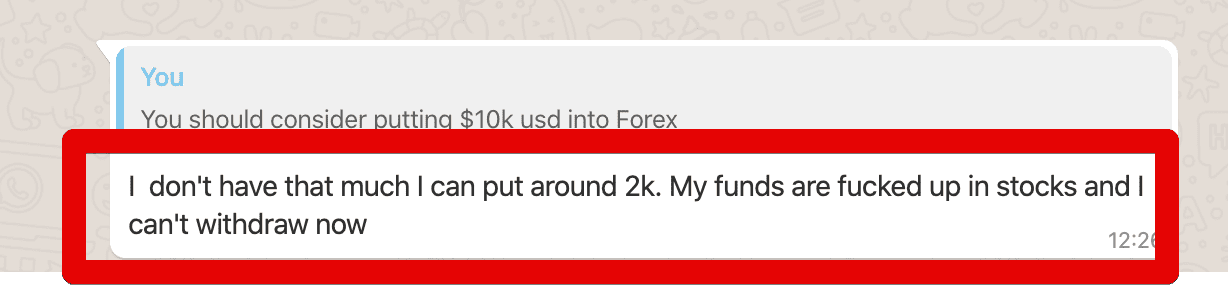

As per my discussion with my cousin Ajay:

And with one of my team:

No-one really knows where to invest their money and how to make it work on an ongoing basis.

Furthermore, the focus upon money is conservation and survival.

One thing is certainly for sure –

There isn’t any ‘one’ place that’s 100% safe.

Not my agency, not Forex, not property, not my pension or ISA.

I do believe with all of that being said – that cash is king – and if you can build income-generating assets – even where the capital gains aren’t huge – I would take cash I can spend today Versus income I need to wait for in the future.

________________

That’s why (given all of the above) – I decided to buy a business.

Yes you read the right – buy a business.

I’ve now bought 4 businesses

(Arthur-OSX, 7upsports, Golf Gear Hub, Shop For Device)

What I want to go through in this blog then is to present a guide as to why, and how you can by a business and the exact steps I’ve taken to buy businesses.

And here’s what we’ll be going through:

Why Not Start Your Own Company?

For most of us – the concept of buying a business seems ridiculous.

Why not simply start your own company right?

You don’t have any control over equity, branding, company setup, product offering, service.

I mean let’s take Pearl Lemon right?

The idea of buying something as involved as an agency seems ludicrous and out of the price league for many of us.

So for many reasons – especially if you’re completely bootstrapped – then building a business probably makes a lot more sense than buying one.

But if you have even $1,000 and up (yes that little) – then you can definitely buy a business that has generated some revenue or one that continues to do so

But first of all, let’s consider:

Why Even Buy A Business?

There is so much effort that’s involved in building a business. You have to:

- Register a domain name

- Decide upon a domain name

- Build a website

- Produce content for the website

- Design the logo, brand colours, font

- Build out the social media profiles

Keep in mind – this is just the actual setup of the website and brand. It doesn’t involve marketplace & competitor analysis. No other research at all.

What about product development?

What about product testing?

What about prospective customers?

What about customer feedback?

What about client acquisition?

And perhaps most importantly what about making your first sale?

And then from there, you need to determine whether this is a sustainable business?

All of these different considerations come into play when you’re building a company – and again I invite you to think about the last business you tried to build and all of the setup involved.

I’ve barely scratched the surface above.

________________

So when you go out and actually buy a business then – all of this value is baked into the business that you go ahead and purchase.

All of this hard work has been done for you – which means that you get all of this intangible value baked into the business upon purchase.

To outline this more I’ll talk about a current business that I’m building from scratch but also underline the huge challenges that it comes with:

Building My First SaaS Company From Scratch

Max Carrol is a schoolboy friend of mine – we’ve known each other since we were 4 years old back at nursery school as we grew up in the same area and went to the same school.

In April of 2019 (12 months ago) we began talking about the idea of building a company together.

Or rather, I’d been posting on Facebook about the idea of building an app for sometime

My vision was building a competitor for this tool:

And we have it’s now this tool:

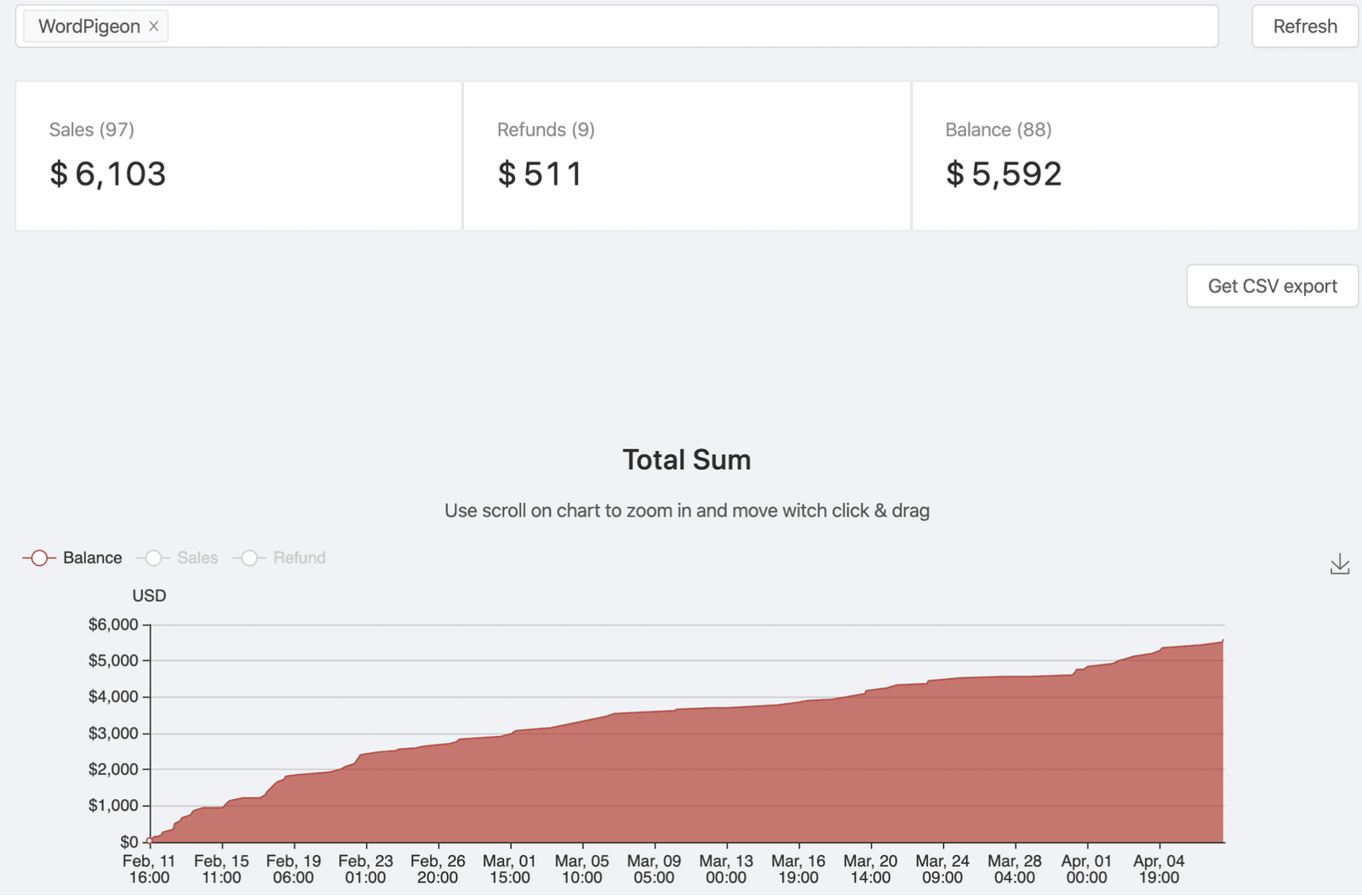

The journey has most recently taken us here:

And we’ve made close to our first 100 sales which has been an amazing adventure for us. (We’ll probably try Stackcommerce next and their offering)

In business terms – this one is a fairly straightforward split.

Our split is 50/50 – Max is the CTO, I’m the CMO and Max has been living off his savings and I have paid for design resources as well as the marketing and organised the Pitchground promotion.

Our tool allows you to post to WordPress and Blogger (and soon Shopify) from Google Docs in one-click whilst retaining all the formatting.

Fundamentally the app makes me no money at the moment because any income Pitchground and so forth will generate need to pay for Max’s salary. That’s ultimately where we want the first £30,000 to go.

Beyond that, we can start splitting the profit.

The Problem With This Model

The problem with this model is that Max and I need to build a brand from scratch, figure out market/product positioning – demonstrate proof of concept and go through all of the pains that this involves.

Max and I started discussing in April but started working on this in July/August and then we’re now a year in and on still are yet to have subscription customers.

When you consider this versus buying a business as discussed above – it’s a far simpler model to follow.

(Of course with all of this being said there are many many people (like me!) who love building things from scratch – as we’re doing at Wordpigeon)

How Can You Actually Afford To Buy A Business?

I got this idea from Ryan Kulp via his Microacquisitions course (affiliate link). This guy has basically made a career of buying businesses.

If you check out my newsletter as well I go into buying businesses in some depth there.

What I fundamentally discovered through this course is the following –

[convertful id=”197358″]

You can typically buy SaaS companies at 2x it’s annual revenue (this is probably inaccurate in many cases) and you can Google it for more accurate references:

But it’s a useful rule of thumb you can work from.

This is in the instance of SaaS.

In the case of affiliate marketing businesses they typically go for 25-30x their last 6 months average revenue:

Then with a digital marketing agency like Pearl Lemon I’ve had people tell me they’ll go for 1-1.5x annual revenue

So there you go.

You’ve got some basic figures there and with loans, seller side financing or just looking at smaller/below-market value companies you can get creative with how you can purchase a business.

The more sophisticated you become the better you can get at buying with other people’s money (I’m not there yet).

What you’ll notice is that none of these valuations bake in:

- Development time

- Brand building time

- Marketing

Also if you check out sites such as:

Flippa,

Empire Flippas

1k Projects

Indiemakers

Microacquire

Facebook Groups

Reddit Groups

(There are likely more)

Basically – there’s a huge marketplace for being able to buy businesses online even if you’re looking at a <$1k budget. You could conceivably pick up something that’s already earning $20-50 per month from the right seller.

Much like property, you can focus on waiting for below-market deals from distressed/bored business owners who are looking to move onto their next thing

What Type of Business Should You Buy?

This is something that Ryan covers in his course and it centres around a couple of specific areas in my view:

Having personal experience in an industry is critical.

So in the instance of Wordpigeon – I was a buyer of our competitor Wordable because it was a problem I needed to solve for myself historically.

And our tool is aimed at content writers – so with this in mind it made sense to build out Wordpigeon because it was a problem of my own I was attempting to solve.

There’s another business that I bought for <$1,000 (7upsports) which on the face of it was (being a sports news site) a business that didn’t make sense in terms of personal experience.

However, professionally I’ve worked with media sites before via my SEO agency and given the relatively inexpensive price – it made sense to give this a go for the experience.

Fundamentally – buying a business in an industry in which you have a convergence of one/some of these makes sense:

- Personal experience

- Technical expertise

- Money to fund growth

You can possibly do 3 in absence of the top two. Or you can start with 3 and develop 1/2 depending upon your time/resource allocation.

The irony is – is that many will tell you ‘don’t start with 3 if you haven’t got 1/2. However, this IS the way people start with real estate investing – although I can appreciate I’m not comparing apples to apples when you factor in the risk associated with this.

Specifically – I run a marketing agency so it gives me some scope to buy and grow businesses. But all of them require time – and in many instances, I DEVOTE more time to them and focus too much on the wrong things at times.

So even with my resources on the SEO side and technical side – even I am still struggling.

Now let’s go into a little more depth with my most recent acquisition:

Buying An Affiliate Business

With all of this in mind, I decided to buy an affiliate site from another SEO friend of mine for a 5-figure fee (£10k lol)

Craig Campbell is someone I know from the SEO game and he’s seen me post in various Facebook groups asking to buy an affiliate website and so then asked if I wanted to buy his.

Now I’ve already made purchases historically – but this is 5x more than what I’ve previously paid.

So the figures involved were significant enough to impact my lifestyle that it means I’ll apply a lot of effort in trying to increase the value of this business.

______________

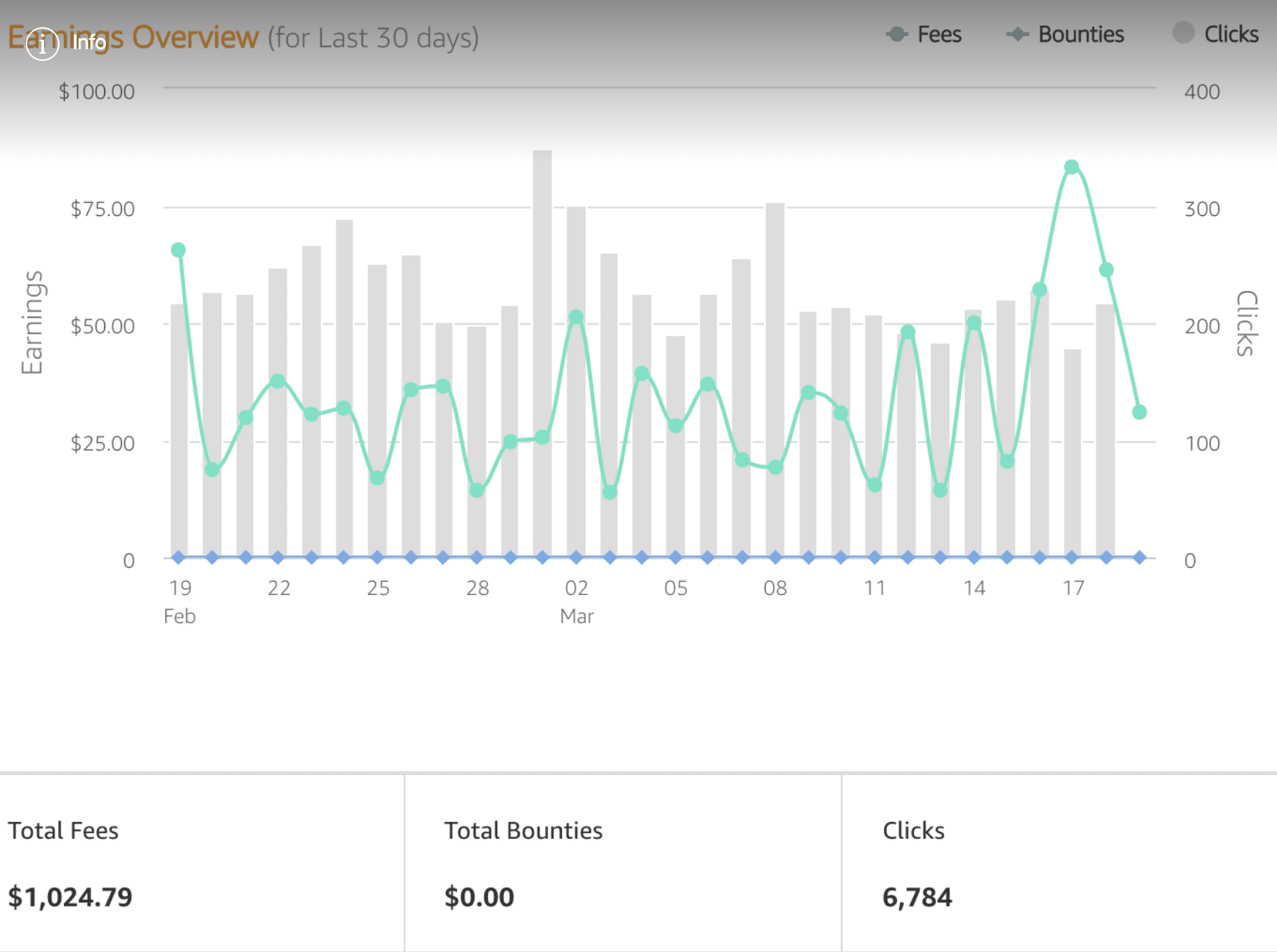

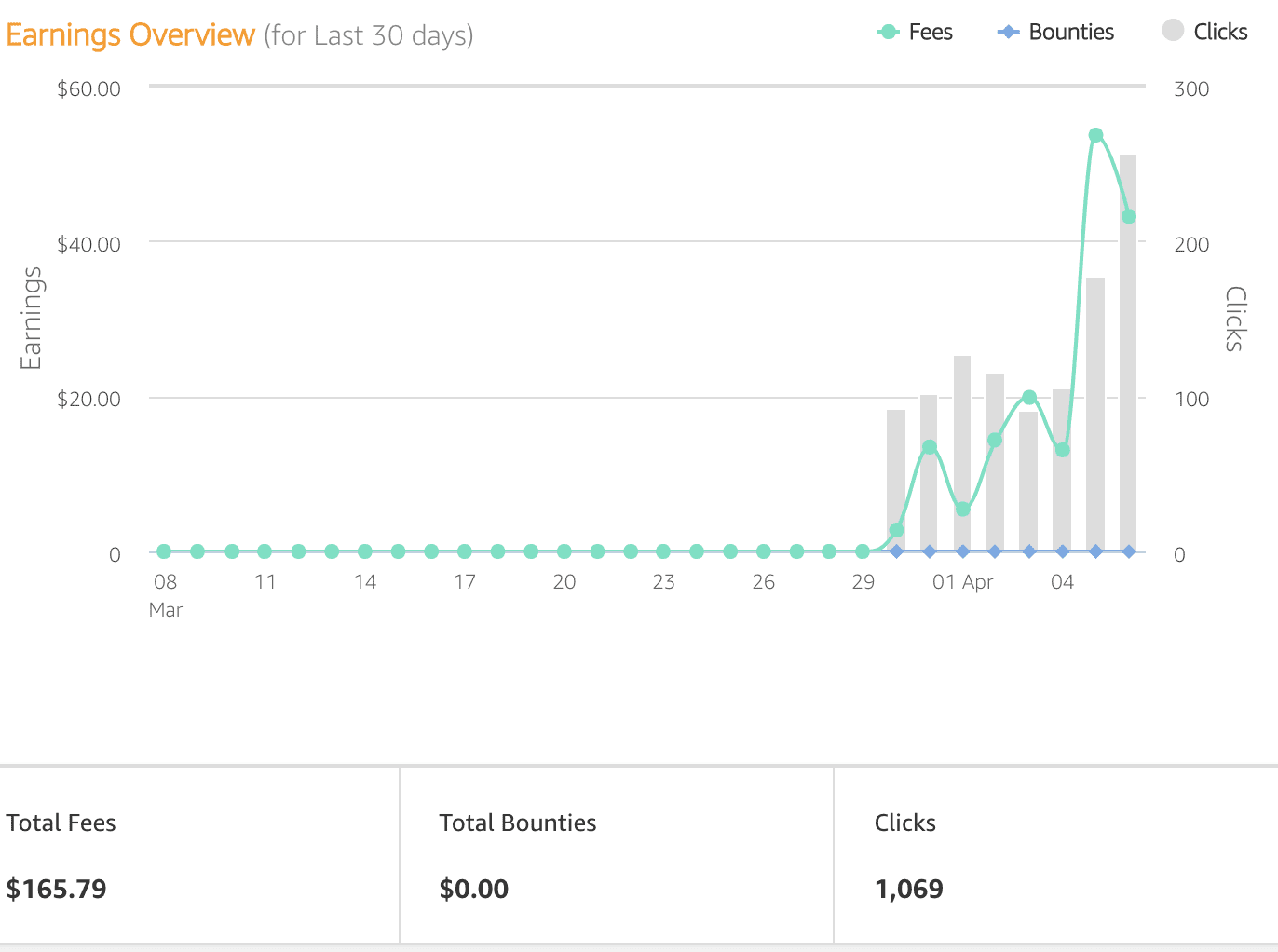

In the instance of the website that I bought here are the most recent figures:

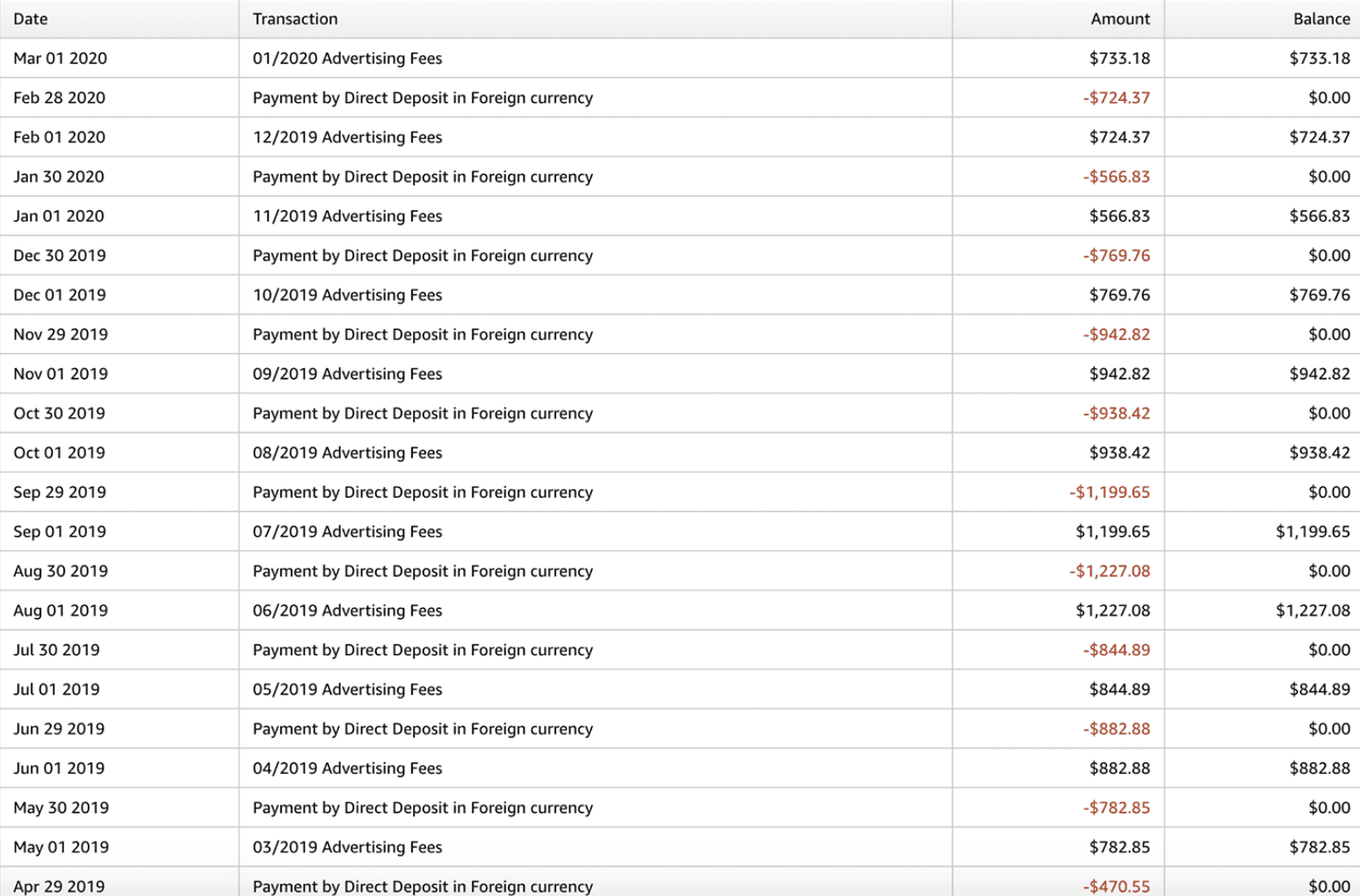

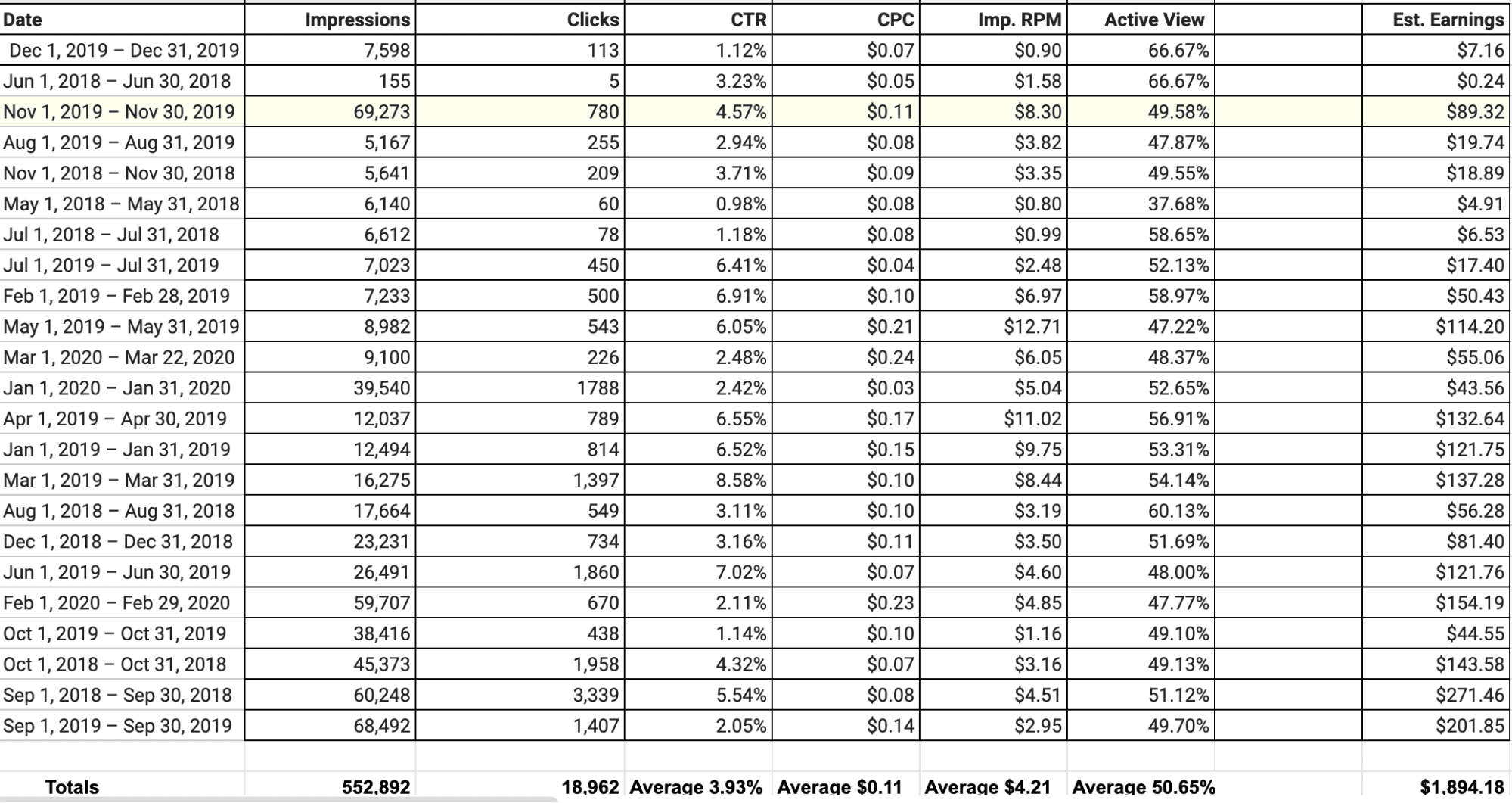

And here are the historical figures:

So last year it did perhaps around £7,500 in revenue with minimal work from the seller.

Which means after the initial cost of purchase – £10,000 – I should be able to (by doing nothing) recoup my investment within 12-16 months.

However, if I work on increasing the revenue than conceivably I should be able to take the site revenue up by 50-100% per month – basically doubling the revenue.

At the moment here is what ISN’T on the website:

- Ezioc for ad monetization

- Push browser notifications for posts to bring returning users

- Swapping out old affiliate products with higher-performing affiliate products

- Adding an email popup for developing a value-led email campaign with perhaps one product on offer for sale per email

- Adding Amazon alternative products with higher margins to see how they sell

- Building another series of backlinks to the site in a solid 3-month SEO campaign and then ‘holding the site’

_______________

This is the plan I have for this business and so far here are some revenue numbers for:

Golf Gear Hub:

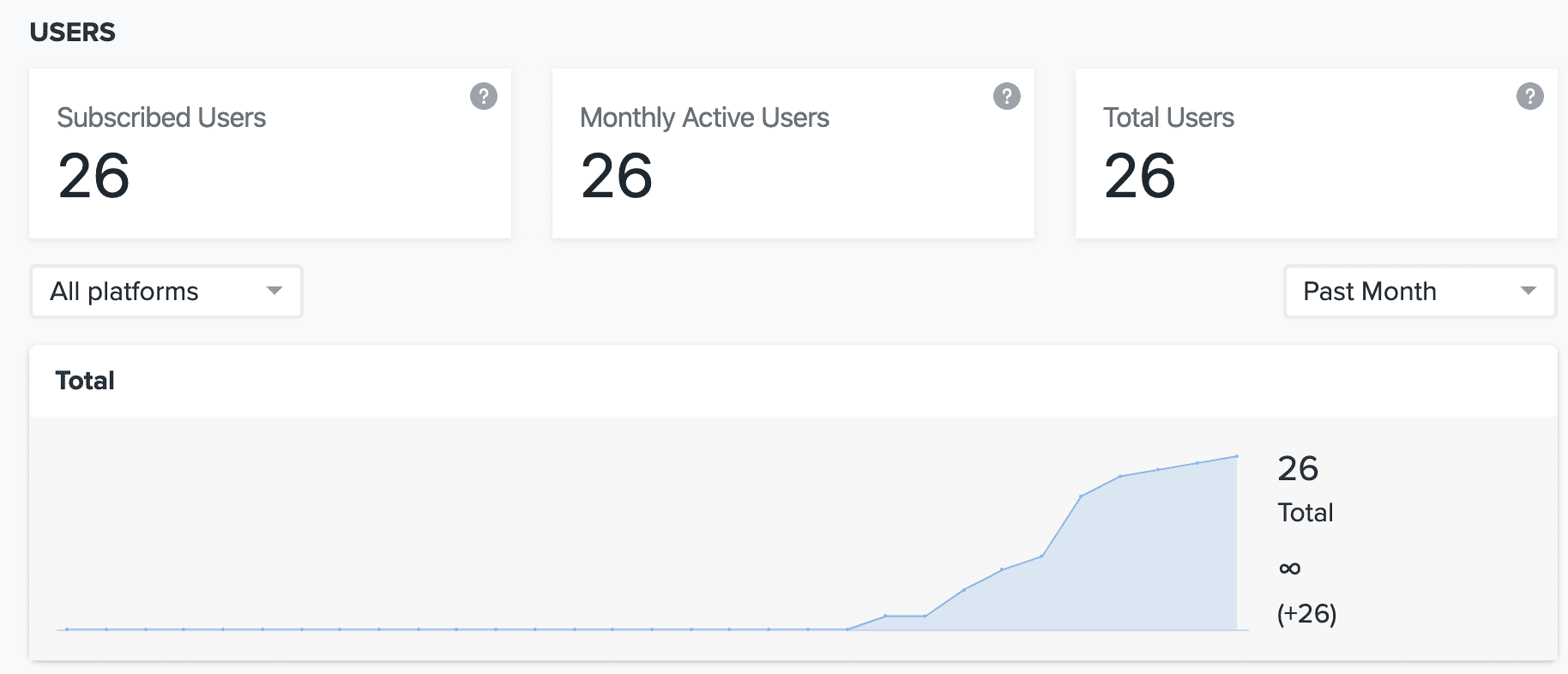

Push Browser Notification Sign-Ups:

Wordpigeon:

7upsports:

Questions?

So look I’m sure I’ve missed out a whole range of things that you have questions about.

If I have (I’m sorry!) – feel free to leave a comment below and I’ll do my best to go ahead and improve this guide as best as I can.

Thanks so much!

D